Accounting Transactions Exercises With Answers

Need help with this problem the last part you have the following information for Shamrock Inc. Lesson 1-1 Practice Quiz 10m.

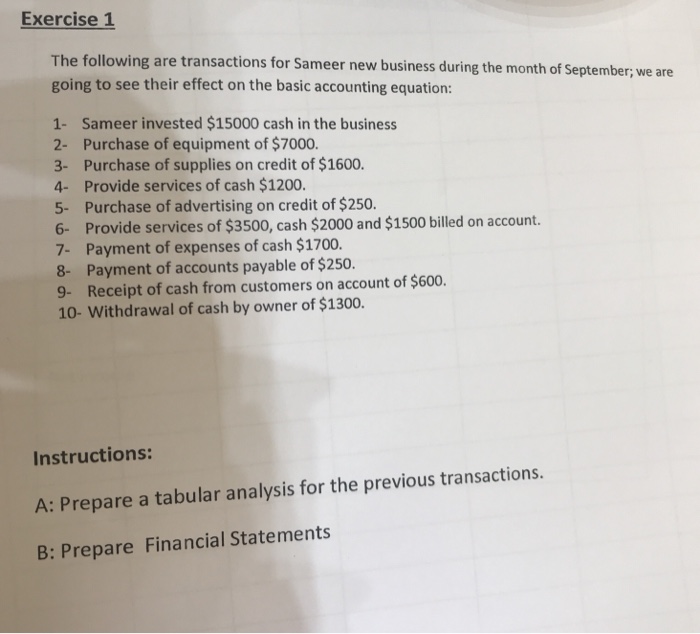

Solved Exercise 1 Understanding Double Entry Accounting Chegg Com

MCQ Questions and Answers on Financial Accounting.

. A Ledger is a principal book of account and its primary purpose is to transfer transactions from a journal and then classify it into separate accounts. Here is an example using the formula Assets Liabilities Equity or Capital. You can find furthermore advanced financial accounting mcqs with answers pdf Model Papers at the site given below.

Check out our official basic accounting books where you can find detailed but simple explanations as well as numerous exercises to test you fully on these topics. BUSINESS TRANSACTIONS AND THE ACCOUNTING EQUATION A transaction is any activity that changes the value of a firms assets liabilities or owners equity. Answers March 01 2008 transactions by.

All forms worksheets. If you face difficulty in solving these exercises or. Use the accounting equation to calculate the answers in each of the following.

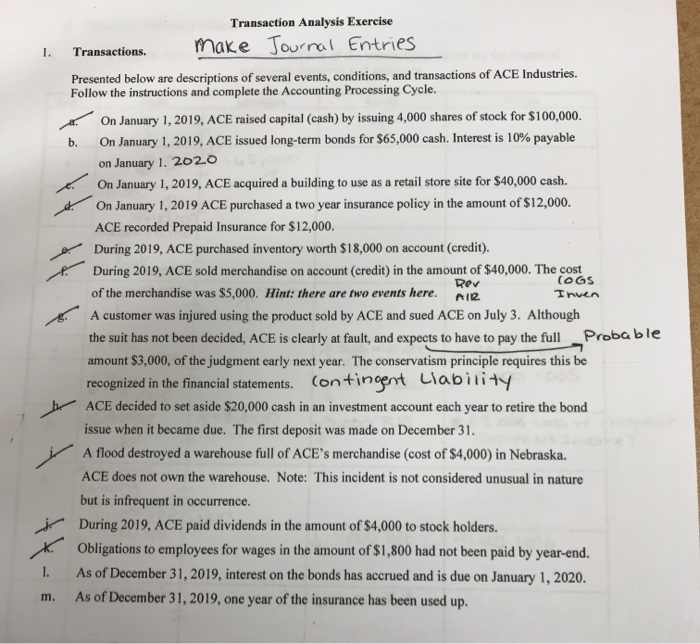

Full Journal Entry Exercise including Depreciation. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Uses the periodic method of accounting for its inventory transactions.

Ledger is also known as the book of final entry as it helps businesses prepare accounting statements like the Trial Balance. There are two main pages of questions and answers on the site. Exercises Number of Exercises.

This short test 9 questions covers the first theory section of this site Basic Accounting Concepts. Find out how accounting equation is calculated after taking into consideration each of the following transactions in the books of Mr. Available for all 13 exercises We have provided the solutions of all the exercises in the statement of cash flows chapter.

The focus of the course is on fundamental accounting concepts and principles. Posting transactions from journals into the general and subsidiary ledgers. You cannot claim ITCs for your operating expenses if you use the quick method of accounting.

ASCII characters only characters found on a standard US keyboard. Basic Accounting Questions and Quizzes - questions and answers about beginner topics from the accounting equation to fixed assets. First up is a basic multiple choice accounting test or quiz taken directly from the Accounting Basics books.

A Tom Jones capital as of December 31 2019 b Tom Jones capital as of December 31 2020 assuming that assets increased by 120000 and liabilities increased by 72000 during 2020 c Tom Jones capital as of December 31 2020 assuming that assets decreased. Workbook has 88 questions and exercises starting from the accounting equation and basic concepts to journal entries T-accounts the trial balance financial statements the cash. Financial Accounting is part of the Finance Accounting Learning TrackIf youre interested in developing deeper insights and expertise you can choose to complete three finance accounting courses within 18 months to earn a Certificate of Specialization.

To record earned sale commission. This quick quiz will test your understanding of the tutorials on defining accounting the accounting equation and its three elements as well as financial position. Related tutorials and exercises.

B Sets forth the solicitation provisions and contract clauses prescribed by this regulation. Get 247 customer support help when you place a homework help service order with us. If you use the quick method of accounting you have to continue using it for at least a year.

THE ACCOUNTING EQUATION Study the examples in the book p. Problem 2-1 Overpriced Jeans Inc. Itll test your understanding of the accounting equation and its main elements - assets liabilities and owners equityIt also covers the financial position of a business.

Tutorial on the Journal Entry for Purchasing an Asset. You are required to make journal t accounts. In case you cannot find your course of study on the list above you can search it on the order form or chat with one of our online agents for assistance.

Statement of cash flows Section. Lesson 1-2 Practice Quiz 14m. You can click through to them straight away or.

This lets us find the most appropriate writer for any type of assignment. And c Presents a matrix listing the FAR provisions and clauses applicable to each principal contract type andor purpose eg fixed-price supply cost-reimbursement research and development. Lesson 1-3 Practice Quiz 8m.

Lesson 1-4 Practice Quiz 6m. 6 to 30 characters long. The final concepts below are actually covered in the next chapter Basic Accounting Transactions.

Full Accounting Questions and Answers - full exercises with accompanying solutions as well as some Q A articles on advanced topics. This course is also part of our three-course Credential of Readiness CORe programconsisting of Business Analytics. However It is always in your best interest that you try enough to solve each exercise yourself before seeing the solution.

This part- a Gives instructions for using provisions and clauses in solicitations andor contracts. Accounting is the process of recording analyzing classifying and summarising the transactions and events pertaining to the financial character and thus interpreting the results. To record payment to creditor.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Students learn how the economic transactions of a firm are reported in the financial statements and related disclosures. How to solve a basic accounting equation.

Must contain at least 4 different symbols. This course provides an introduction to financial statements and the financial reporting process from a users perspective. The features of a ledger are as follows.

This accounting practice set includes 56 transactions for the month of December that the student records in each of the exercises. Fundamental accounting concepts and revenue recognition principles are at the heart of coding financial transactions in accounting language as well as preparation of financial statements from these. To record payment for automobile miscellaneous expense.

Started business with capital 100000. To record paid for office and equipment rental To record withdraw by owner. The first chapter of the Class 11 syllabus provides the student with a basic understanding of the concepts important and relevant to the study of accounting.

5 Assets Liabilities Owners Equity This equation must always balance. Additional Key Accounting Concepts. The quick method remittance.

To record purchase supplies on account. Anonymous To record investment by owner. What are its features.

For more information see Guide RC4058 Quick Method of Accounting for GSTHST. By practicing financial accounting mcq with answers Previous Papers Applicants can know the difficulty level of exam. There are other rules as well.

On March 30 2022 the SEC issued a proposed rule 2 that would enhance investor protections in IPOs by SPACs and in subsequent business combination transactions between SPACs and private operating companies also known as de-SPAC transactions The objective of the proposed rule is to more closely align the financial statement reporting requirements in. Each of the bookkeeping exercises requires between 4 and 6 hours to complete. If you want more practice with full accounting questions and answers you should get the official exercise book for this site Volume 2 in the Accounting Basics series.

Solved Exercise 1 The Following Are Transactions For Sameer Chegg Com

Solved Transaction Analysis Exercise Make Journal Entries 1 Chegg Com

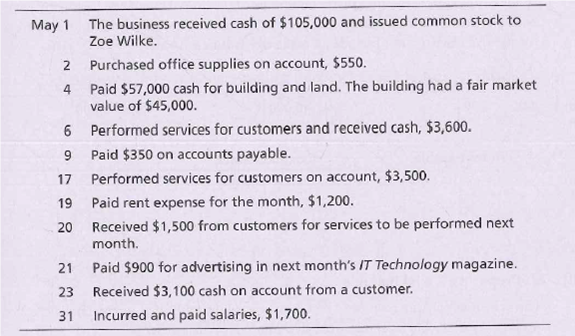

Answered The Business Received Cash Of 105 000 Bartleby

Solved Exercise Begins An Accounting Cycle That Will Be Chegg Com

No comments for "Accounting Transactions Exercises With Answers"

Post a Comment